I have been thinking for a while about writing an article on ClearPoint Neuro and been asked by several investors to walk them through the business and also to publish my notes. If you have followed me for a while on Twitter you know that I have been tweeting about ClearPoint Neuro for a while and is one of my highest convictions and my largest holding at this point.

Understanding this business has not been a single-person operation, this is a teamwork effort and many investors and different contact helped me along the way to learn more about the business and build my conviction over time. FinTwit is all about collaboration. I would like to thank the following people on FinTwit for either sharing great insight, challenging our ideas, and all the lengthy discussions to better understand the business. In no particular order: @hiddensmallcaps, @RodriGo_ethe, @SlingshotCap, @hareng_rouge, @BostonDrei, @Bonerogue, @alixpasquet, @biggercapital, @Rakapital, @Read_cap, @philbbelanger, @pepersoons, @CapitalCatalyst, @NextEdgeCapital, last but not least @SRQForever (our medical specialist), and others I might have forgotten to include.

I have decided to walk you through the key highlights from my notes and what makes this company special to me.

Understanding the business:

ClearPoint Neuro in an image:

Quick summary

How ClearPoint Neuro describes its business:

“The ClearPoint Neuro Navigation System is currently utilized at 60 of the top neurosurgical centers in the United States. The System empowers MRI-guidance for a range of procedures including deep brain stimulation (“DBS”), laser catheters, drug delivery and biopsies allowing neurosurgeons to leverage live MRI imaging to decide, guide and confirm procedures with sub-millimetric accuracy.” ClearPoint Neuro

I breakdown the company into two major components of the business:

Functional side including minimal invasive surgeries and Deep brain stimulation (“DBS”)

Biological side

The “biotech platform” so to speak. They have multiple partners on the biological side. (Note: I won’t go into all the partners in this blog post) ClearPoint Neuro gets revenue during the different phases of the trials no matter the outcome, FDA approved or not, no downside risk of the drug failures and don’t need to spend for the marketing of the drugs. This is what will drive most of the value of the company and is underappreciated by the market IMO (or was following the recent appreciation in the share price).

What struck me as well with their partners is a lot of them are in Phase 2 or starting Phase 3. There is a higher probability of commercialization for drug post Phase 2. There are usually more deals as well in Phase 3.

Source: Next Edge Biotech and Life Sciences Opportunities Fund Presentation

It is an investment that helps to saves and improves the lives of children and adults suffering from rare diseases and unmet medical needs.

Seven-year-old Hallie Campbell from Wigan doing well after brain surgery in Poland

I would suggest you read @biggercapital post linked below, go through the Investor Presentations if it is not already done, and read the excellent Seeking Alpha article ClearPoint Neuro: Becoming The World's Pre-Eminent Neurosurgery Platform by @CapitalCatalyst

I will “try” not to duplicate the information that is already published there and rather add my comments.

How I discovered the idea:

I discovered in 2017 when it was trading as MRI Interventions $MRIC via @biggercapital on FinTwit:

The stock was trading on the OTC at the time. I looked into the idea and what struck me was this idea of a “biotech platform” without the downside risk. They had 5 partners in 2017 at the time and kept track of the growth on the biological side of the business. I started a position once it got uplisted and been averaging up since they have added partners.

We now know they grew to 25+ partners per Nov 2020 Investor Presentation.

The new CEO Joe Burnett since 2017 really put the emphasis and focus on the growth of the biological side of the business.

To me, ClearPoint Neuro was kind of a turnaround-style investment “à la” Joel Greenblatt at the time.

We started to see really good traction in 2020 and been averaging during each quarter since then:

Competitive advantage:

It is the only company to help deliver a drug by accurate catheter placement through the brain barrier using real-time MRI. There is no other real-time MRI platform available on the market. Medtronic has the NexFrame platform that is used in a static way.

ClearPoint Neuro process would be used upon any clinical trials FDA approval

Data

@hiddensmallcaps nailed it with this Tweet.

Intellectual Property:

89 patents in the United States, and over 184 worldwide patents.

Network effect:

“ClearPoint are in 60-something hospitals today. Their goal is to have 80 centers of excellence in the US in mid- to long-term. These are centers that will perform >2 surgeries per week with CLPT. Out of the 60 hospitals, they are in today, roughly 10-20 do >2 surgeries per week (in other words, 10-20 are centers of excellence). What I mean by cementing themself is that I want them to take that 10-20 number and move it towards having 40-50 centers of excellence. So it is more a factor of increasing utilization at current hospitals rather than enter new ones. Hope it cleared things up. EU target: one per country.

Capacity to make 2000 surgeries with the current team of 20 experts (roughly 3 per week today – imaging the boost to profitability when they can make 6 surgeries at an average price point of 25-40% higher than today). “Real capacity” at around 1400-1500 surgeries due to cancelation and they need some overcapacity. “ @Rakapital

When the CEO was asked how they intend to scale up to meet the demand?

“And I think the reality is, is that the future of neurosurgery, probably around the world, is not 250 or 2,000 centers doing one case a month. It's going to be concentrated in a much tighter group of centers of excellence that are trained to do 3 or 4 procedures a day and just churn at almost like a lean manufacturing line. And I think it remains to be seen exactly who those centers are. - Joseph Burnett (Source Q3 conference call transcript).

The strategy, for now, seems to cement itself in a few more hospitals to increase adoption by more Neurosurgeons.

Europe expansion:

“The procedure, which took place last week, also represents the first European site to use the ClearPoint System under live MRI guidance for navigation of a laser catheter in the brain.”

Joseph Burnett commented on the Q3 Conference call: “To put it into perspective, if COVID hadn't hit, I would imagine we would have 4 or 5 active European centers already. And it's directly a 1-for-1 month delay so far.”

The target is to have 1 center per country.

The potential scale of economics

iMRI-Guided Gene Therapy and Drug Delivery for CNS Disorders

Leveraging real-time MRI guidance for intracranial gene therapy administration potentially improves efficacy and outcomes.

Economic Impact

“Although it may be premature to assign hard savings to iMRI-guided drug delivery, there are significant potential benefits from such an approach. Given the tremendous R&D costs to develop a gene therapy as well as the cost of a single dose and the infusion procedure, any increase in the likelihood of a successful procedure would translate into considerable savings for the healthcare industry at large—as well as accelerating adoption of pharmaceutical gene therapies. The potential for iMRI guidance to ensure safe and accurate placement of the catheter, administer patient-specific dosages, minimize leakage, and optimize coverage addresses many of the challenges faced by early gene therapy trials. When considering the costs of past negative phase two trials, the business case for leveraging iMRI is apparent.”

A win-win relationship for all stakeholders:

To me, this is the “AHA moment” when the stars aligned and it all became clear in my head there was something special about this company. You have a new CEO bringing up a quality team together (a lot of his previous teammates from his previous endeavor at Philips), multiple strategic investors coming on board, clinical specialists on-site assisting, Neurosurgeons advocating for ClearPoint Neuro, and making sure the care of patients for better life quality plays a major role. Even their customers are seen as partners. All this tied together to create a nice feedback loop, a flywheel as your heard many times, whatever you want to call it that drives a special force in the future growth of the company.

Management and team:

CEO

Nov 17th, 2017 Joseph Burnett was brought from Royal Philips

I just want to highlight how the CEO started the Second Quarter of 2020 during the beginning of covid:

Our priorities during the second quarter for the company and for our team and culture were threefold: number one, to make sure that every patient that needed treatment felt supported by the availability of ClearPoint products and our team members. We wanted to ensure that surgeries performed during COVID restrictions gave the patient the best possible chance of success. Number two, while cases decreased in the quarter, we wanted to ensure our development projects and investments in our talented team continue to move forward so that our strategy is intact and so that we exit the crisis in a stronger position than when the pandemic started. And number three, to protect our employees from layoffs or furloughs so that they can be a pillar of strength for friends and family who have all been impacted by the health or financial impact of the crisis. - Joseph Burnett Q2 conference call transcript

Compensation performance-based despite low insider ownership:

“Joe has 40% performance-based salary with focus on growth, placed instruments, and strategic goals (50%/50% of the performance-based salary is current performance / strategic). “ @Rakapital

CFO

Sept 14th, 2020: ClearPoint Neuro Announces Transition Plan for New Chief Financial Officer

Look on LinkedIn at the number of comments Danilo D’Alessandro when he announced his transition to Chief Financial Officer at ClearPoint Neuro.

What was interesting about this announcement was his vast experience in M&A. This made investors think and speculate what could be next.

Case in point on Jan 22nd, 2021 ClearPoint Neuro did an S-3 filing for $120mil shelf offering Let’s see what the future might bring.

Biologics drug delivery team:

From July to August 2020 the company added 4 new members all from Royal Philips (where the CEO came from)

Europe team:

In Oct 2020, they hired the 1st Clinical Specialist for Europe from Medtronic

George Protopapas, Clinical Specialist EMEA at ClearPoint Neuro, Inc., United Kingdom

In August 2020, Matthew Rabon was put in charge of Clinical & Business Development Manager EMEA

Strategic Investments:

Sep 12, 2016: Voyager Therapeutics, Inc. discloses 21.04% activist ownership in MRIC / MRI Interventions Inc

May 9, 2019 - PTC Therapeutics and MRI Interventions Announce Strategic Investment

Jan. 29, 2020 - MRI Interventions, Inc. Closes $17.5 Million Strategic Investment from PTC Therapeutics, Inc. and Petrichor Healthcare Capital Management

Dec 29th, 2020: ClearPoint Neuro, Inc. Announces Funding of Additional $7.5M of Existing Convertible Note on Improved Terms

Interestingly enough, Petrichor invested in Cryoport in Dec 2018 and this investment returned 500%+ within 2 years.

Cryoport Announces $25 Million Investment from Petrichor Healthcare Capital Management

Mayo Clinic owns 47,168 shares of ClearPoint Neuro, again a win-win for all stakeholders (source TIKR)

Neurosurgeon advocating ClearPoint Neuro:

You have some of the best neurosurgeons in the world who are advocates of the platform who are supported by Clinical Specialists.

Mark Richardson Head neurosurgeon at MGH, and professor at Harvard and MIT

"There is no competitive offering that compares to ClearPoint Neuro "

Jason Gerrard, MD, Ph.D. Director of Functional & Stereotactic Neurosurgery at Yale Neurosurgery

"I know in real time that this electrode is going right down the barrel of the hippocampus" (Epilepsy RNS lead placement)

Clark C. Chen, MD, PhD, Neurosurgeon in Minneapolis, MN

Dr. Krystof Bankiewicz is leading two ongoing gene therapy clinical trials in Parkinson’s disease and in pediatric neurotransmitter deficiency. He started Voyager also has a strategic investment in ClearPoint Neuro. He also founded AskBio which was acquired by Bayer for $ 4B.

Feedback from customer PTC Therapeutics:

PTC Therapeutics has invested in CLPT to, partly, secure the technology, as a good investment and to deepen their partnership. They confirm that ClearPoint Neuro system is the best.

I had a conversation with PTC Therapeutics and they believe ClearPoint Neuro is trying to create a monopoly on neurosurgery, both for minimal invasive surgery and delivery.

Patient Quality of Life During Surgery

“The most glaring advantage that ClearPoint has over Nexframe is the patient does not need to be moved from room to room for imaging planning and operating. Again, moving the patient may result in shifts in the brain due to movement from suite to suite. As a result patients are typically taken off medication and have to be awake during the entire process. With ClearPoint, real-time imaging lets the patient be under general anesthesia for the entire procedure, improving the patient's quality of life.” @CapitalCatalyst (source ClearPoint Neuro: Becoming The World's Pre-Eminent Neurosurgery Platform)

Deep brain stimulation DBS is currently done mostly with awake patients. HFHS says ~80% of their DBS treatments are done asleep that offers great patient comfort. DBS market opportunity is ~$72mil

“Asleep, image-guided deep brain stimulation (DBS) placement is rapidly gaining popularity because it offers greater patient comfort and comparable accuracy with frame-based methods using microelectrode recording” (source PubMed)

“Employing the ClearPoint system for asleep DBS, HFHS neurosurgeons are routinely expected to achieve submillimetric accuracy in lead placement procedures.

…ClearPoint’s aiming device and software were developed specifically for iMRI interventions.” “many of the asleep DBS guidance measures are automated, potentially saving time while maintaining flexibility and increased control over the procedure.

…the asleep version combines much of the planning phase with the actual surgery, streamlining the overall process and, according to HFHS neurosurgeons, results in a more focused, less stressful surgery.” (source Neurology Live Nov 2020

Training and Innovation center

“ClearPoint Neuro is looking for a bright, talented new team member to be part of our exciting story. The successful candidate for our Office Manager position will help us operationalize and grow our new Training & Innovation center which overlooks the beach in beautiful Fletcher’s Cove, Solana Beach. If you or someone you know is interested in being part of a growth company dedicated to improving and restoring quality of life to patients and their families”

Tailwinds and life science sector:

Or why is this a good sector to invest in right now? I always like to see tailwinds and convergence of experts in the field and the literature. The question I like to ask: Will there be a flow of money coming?

Tailwinds:

“Waiting for the Biden brain cancer initiative as well, expecting a lot of funding during his term” @SRQForever

The Other Pandemic: What to Do About the Coming Alzheimer’s Crisis

With the world in the midst of an aging boom, the number of people living with Alzheimer’s or some form of dementia is expected to triple by 2050 to 152 million—a bit more than the population of Russia today.

Life science sector:

ARK Invest

ARK Invest Investment Focus: Gene Therapy

Source: ARK Big Ideas Report 2021

Medtech space:

What Intuitive is looking for through its new $100M venture fund

"Our mission in the venture fund is really to accelerate minimally invasive care; robotic surgery is one component of it, of course," said medtech veteran Julian Nikolchev, who joined Intuitive Surgical last year as its SVP of corporate development and strategy, and also serves as president of Intuitive Ventures (IV).

"But the other aspect is some of the new technologies and new tools that are coming in that space — digital tools, focal therapeutics and precision diagnostics."

Steris inks $4.6B buy of Cantel Medical amid flurry of M&A

“EY consultants said that medtech M&A will take off in 2021 due to a record high of nearly $500 billion in financial firepower. While 2021 has already seen multiple tuck-ins, EY projected that a handful of deals over $1 billion is likely.”

Biomedical Panel

An interesting panel titled Biomedical Sector Continues Growth Streak was hosted on Nov 12th, 2020. There are comparisons between the US and Canadian market for Life Science and discussion about listing to the US with the managing director and chairman of biotechnology investment banking with Morgan Stanley in the US.

Basically, money is flowing in oncology and rare disease.

“Canada’s biomedical sector presents significant growth opportunities for investors, according to speakers at a Globe and Mail virtual summit on November 12. The event, called “Biomedical Boom: Leveraging new Canadian growth opportunities,” brought investors and biotech entrepreneurs together to discuss the current and future potential of the industry.”

Jessica Chutter, managing director and chairman of biotechnology investment banking with Morgan Stanley

NASDAQ Biotech Index

Next Edge Capital who runs the “Next Edge Biotech and Life Sciences Opportunities Fund” makes the case for a potential bull market

Source: Next Edge Biotech and Life Sciences Opportunities Fund Presentation

Gene Therapy space:

There has been a recent acquisition in the gene therapy space on Dec 15th, 2020. Eli Lilly to Buy Prevail for $1 Billion in Parkinson’s Push. Their pipeline doesn't have a single trial in Phase 2b, 3, or pivotal.

Insider Ownership

What I learned about my years investing in small caps from @iancassel is to invest where the institution's money is going next.

The current ownership is as follow:

28.9% Major holders

4.3% Mutual funds

6.3% Institutions

I am tracking institutional/mutual funds ownership and a Vanguard Index bought 0.7% of O/S from Nov 23rd, 2020 to Jan 19th, 2021. The institutional ownership looks like rounding errors to me. Some probably acquired shares when they uplisted to the NASDAQ and some index might have caught it this way.

Source TIKR

Funds

I talked with a few hedge funds and it seems it is overlooked by a lot of hedge funds as it is too small. The hedge funds that took the time to look into ClearPoint Neuro and also surveyed within their network confirm the same thought as well that it is a complicated story at first sight.

Market expectations:

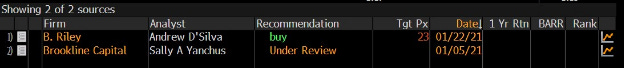

Analyst coverage:

B.Riley is currently the only analyst covering ClearPoint at this point and have been raising their price targets several times since the end of 2020:

A new analyst is under review from Brookline Capital Markets is under review since January 2021

Sally Yanchus, M.B.A, is a Senior Life Sciences Analyst at Brookline. Ms. Yanchus has significant experience as a healthcare analyst on both the buy and the sell sides. She was most recently the global healthcare analyst at Tradewinds Global Investments, a division of Nuveen. Prior to that she was a pharmaceutical and biotech analyst at Bessemer Investments and a biotech analyst at The Galleon Group. Ms. Yanchus covered life sciences stocks on the sell side at Oppenheimer & Co., Lehman Brothers, and Morgan Stanley.

She graduated magna cum laude and Phi Betta Kappa from Wellesley College with a B.A. in Economics, and received her M.B.A. in Finance from Columbia University’s School of Business.

Earnings and Revenue beat

ClearPoint Neuro has been beating the only analyst expectations in the last 3 quarters.

Market Awareness on social media:

Stocktwits “Watch” statistics:

From less than 300 “Watchers” in 2019 to 693 on Dec 21st, 2020

Jan 19th, 2021: 1006 (broke 1000 followers)

FinTwit:

Besides @biggercapital in 2017...there wasn’t much discussion on it.

Some key financials I follow:

Gross Margins expansion mainly due to the growth of biologics

SG&A has increased due to Clinical Specialists being flown on-site cost to increase awareness and support. Thinking this should eventually be lower over time and increase Gross Margins +70%?

R&D perhaps should increase?

Biologics revenue trend…up:

Unit economics: It is interesting to note that revenue per case has been increasing. Do they benefit from pricing power?

Valuation comparable:

Some potential comparables often mentionned $CYRX $MCXT $LUND $SWAV

Perhaps the correct way to value this company is to assign a value to the functional side more as a MedTech and another one to the biological side more as a life science company?

Catalyst and Investment Optionality:

2021 Catalyst in the near term:

AADC trial from PTC Therapeutics ~$12mil

New CLS Laser to drive revenue 2 to 3x per case in 1H 2021 (source Q3 conference call)

Europe expansion for biological side and drive more partners/clinical trials

Possible M&A?

Investment Optionality

Some open questions/ideas without answers regarding potential call options that could drive revenue eventually.

How many partners/clinical trials?

It is very difficult to find all the partners/clinical trials as, for the most part, ClearPoint Neuro does not disclose them all yet. Maybe this will be the topic of another blog post.

Expand into heart drug delivery?

Expand into spinal drug delivery?

Possible M&A of tech? i.e. a cannula for spinal drug delivery

Expand into prostate cancer?

with the new CLS Laser?

“…new generation of TRANBERGproducts on the European market, with focus on image guided laser ablation treatment in prostate and brain. “

Catheter design for acute stroke

The Mayo Clinic in Florida developed a Novel aspiration catheter design for acute stroke thrombectomy. A type of stroke that causes bleeding deep within the brain.

“ICH is a type of stroke caused by bleeding deep within the brain. It is considered the deadliest class of stroke due to accumulation of blood and clot in the brain, resulting in compression of adjacent brain tissue and toxicity to brain cells surrounding the damaged area. ICH occurs in 80,000-100,000 Americans annually, and is fatal in 30 to 50% of all occurrences. ICH is the only major stroke subtype without a clearly effective treatment and represents one of the greatest unmet clinical needs in acute stroke care.”

If they capture 5% of this....80,000* USD 8000 estimates * 5% = ~$32mil potential annual revenue

A contact found out 2 hospitals outside of Mayo Clinic in Florida are using this and we are assuming more. ClearPoint Neuro started to roll this out. No mention in the Investor Presentation and in B.Riley report about this revenue stream.

Surgery clinics

Pure speculation but Siemens launches in Q3 2020 its smallest and most lightweight whole-body MRI. What if ClearPoint would not be tied to hospitals anymore with a new portable MRI and they could have surgery clinics outside hospitals? Cases will be able to be handled at surgery clinics. Let’s imagine for a second the Neurosurgeon return on time

“I mean, the reality is the good thing for us is that even though we are active today in MRI scanners and that's kind of where our world is focused, it doesn't mean we're always going to be only locked to MR.

We're also doing some work in the operating room as well. But most importantly, we don't need a 7 Tesla scanner to do what we do. In fact, we can use a 1.5 Tesla scanner and have exactly the type of imaging we need for this type -- these types of procedures. So I mean, you can imagine a situation in the future where a neurosurgery center of excellence might have 5 older 1.5 Tesla scanners. And then they become the place that you get referred to and maybe even hop on a plane or travel to, to get these procedures done.” - Joseph Burnett (source Q3 conference call transcript)

Institutional buying:

Could a fund like ARK Invest or any other Life Science fund take a meaningful position in the future in ClearPoint Neuro? ARK Invest certainly does own a stake in smaller caps sub $1B.

Summary

What could this unique company be worth in the future? I don’t know but I believe a lot more. The fact that it is still overlooked and has low institutional funds could bring a flow of money. We could certainly see another re-rating along with the growth of the functional and biological side. I will continue to monitor the number of partners the growth of biologics revenue and maybe this will be a topic for another blog post.

When I think about ClearPoint Neuro this song always come up in my head :) I also suggest rereading or reviewing the article and some links with this music in the background. It might help to make sense.

That’s it for now. Hope you find some value in this post if you made it all the way through.

Disclosure: I am long CLPT shares.

You can support my work by buying me a coffee or whatever donation you feel like:

Hi Max, Are you still invested in CLPT? I don't see any tweets recently about CLPT from you and would love to hear your latest thoughts on it.

Cup of coffee sent. Very informative and insightful read. Long $CLPT